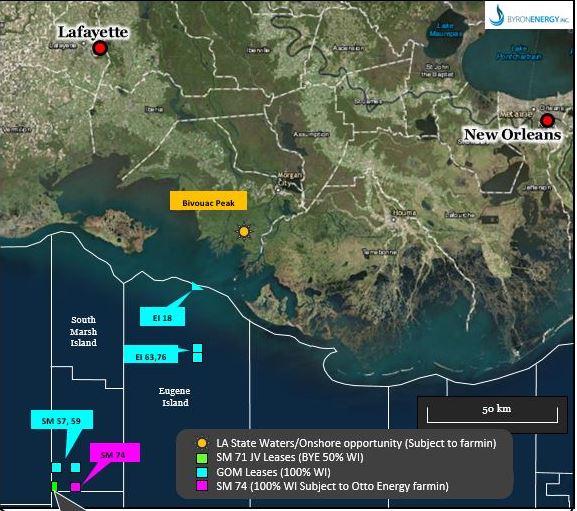

ASX-listed Byron Energy has hit 90 percent production capacity at its SM 71 F platform in the Gulf of Mexico, ramping up operations following a pipeline shut-in earlier in April.

Production from the company’s SM 71 F platform began on March 23 from the SM 71 F1 and F2 wells with the F3 well following suite on April 6. For the period March 23 to April 25, the three wells produced a total gross sales volume of 83,000 barrels of oil and 55.5 mm cubic feet of natural gas.

Byron said the pipeline transporting oil from the SM 71 F platform was shut in on April 19 for four days for maintenance work.

During the shut-in period, Byron said it had made several improvements to the production system on the platform, mostly focussed on resizing valves to optimize production levels and minimize downtime.

The company said all three wells had returned to production on April 22 at a combined average rate of 4,650 bopd and 3,200 mcfgpd – representing over 90% of the platform’s throughput capacity.

“By producing at this rate, we will minimize facility issues and reduce downtime which is currently expected to average 4% per month. This rate of production also optimizes drawdown on each of the wells and should maximize the ultimate long-term recovery from the reservoirs,” the company said.

Maynard V. Smith, Byron’s CEO, said: “We are very pleased to have had such a smooth start-up of production from our SM71 F platform. Operational and facility issues have been minimal and are fully in line with the types of issues associated with any new oil production facility.

“With oil prices at a three-year high, we are especially happy to be producing at these levels to take full advantage of the current price scenario. This income will allow Byron to pursue further opportunities within our very exciting inventory of internally generated prospects and thereby significantly increase shareholder value. The timing of initial production at SM71 could not have been better.”

Byron, through its wholly-owned subsidiary Byron Energy Inc., is operator of SM 71 and holds a 50% working interest and a 40.625% net revenue interest in SM 71. Otto Energy holds the remaining interest in SM 71.