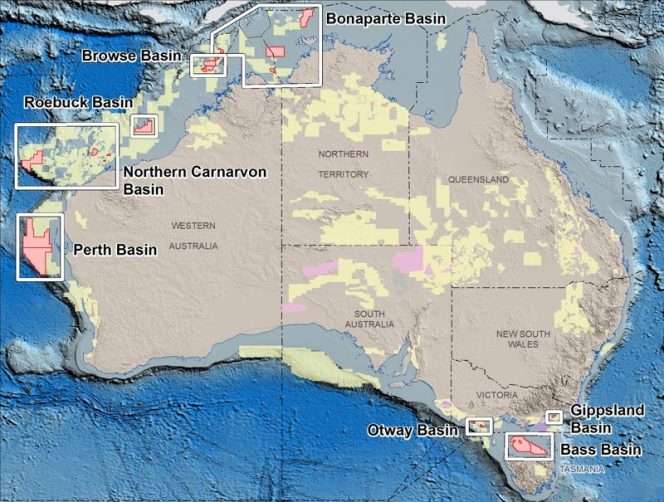

A farm-out deal with Origin Energy has put Buru Energy in the starting blocks for an expanded exploration program in the Canning Basin during 2021.

With a solid balance sheet, no debt and a committed new partner, Buru Energy said it would be targeting two conventional oil exploration wells at Kurrajong 1 and Rafael 1,

Buru Executive Chairman, Eric Streitberg, said: “The last quarter of 2020 was a seminal period for the company with the execution of a transaction with Origin Energy that will underpin a major exploration program on the company’s Canning Basin exploration permits during 2021.

“The exploration program will include a major regional seismic acquisition program and the drilling of potentially company changing, conventional oil exploration wells.

Origin Energy’s participation in a basin-wide exploration program is seen by Buru as a big vote of confidence in the basin’s prospectivity and of Buru’s ability and experience as operator in the Kimberley’s Canning Basin.

“We have moved quickly to kick start the exploration program, building on the work done in the last quarter to prepare for a wide-ranging program during 2021,” Streitberg added.

“A preferred seismic contractor has been identified with a contract award expected shortly. Several drilling-rigs suitable for the program have also been identified, and a drilling contract is expected to be awarded once contract negotiations are completed.

“Buru has production from our Ungani Oilfield, a strong balance sheet, no debt, and a committed new partner, and we are very much looking forward to a revitalised and high-potential exploration program during 2021.”

Super seismic

Buru Energy said the basin-wide exploration program was set to start at the end of the current northern Australian wet season. In addition to the wells, some 1200km of seismic will also be acquired over regional areas and conventional oil exploration targets.

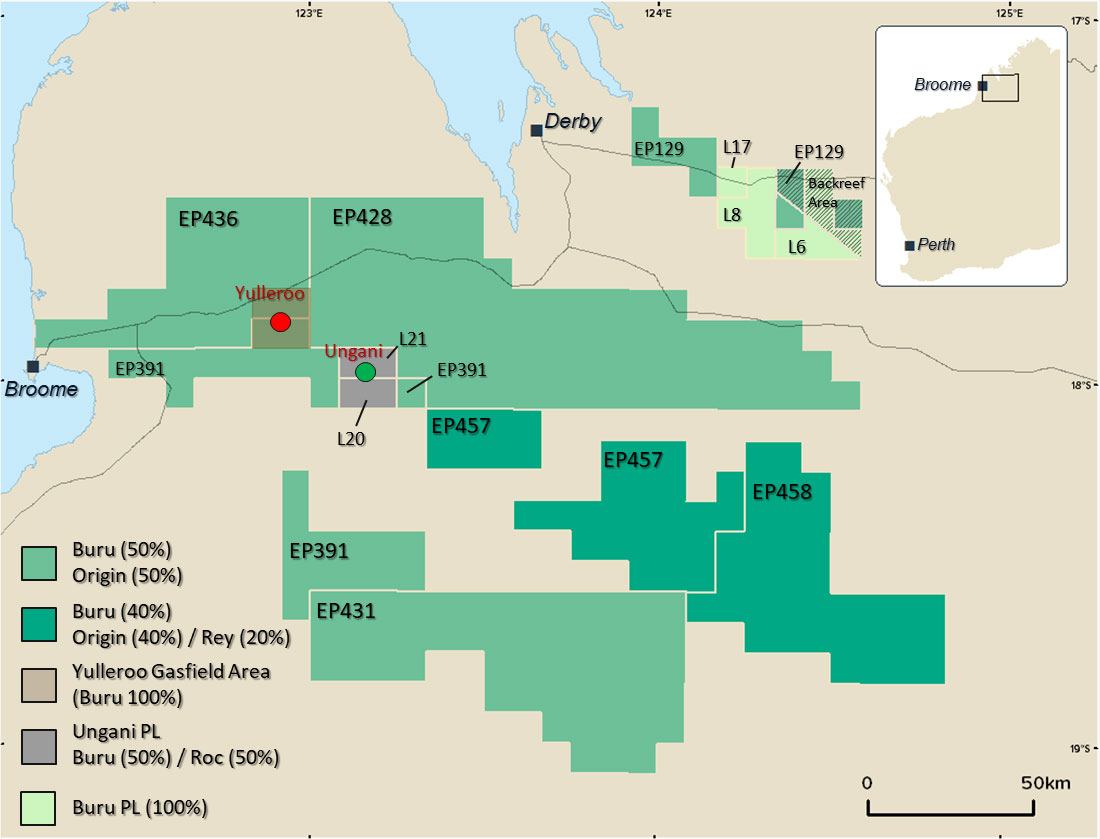

Origin will earn a 50% interest in exploration permits EP 129, EP 391, EP 428, EP 431 and EP 436, which were previously 100% owned by Buru, and a 40% interest in the EP 457 and EP 458 permits held by subsidiaries of Buru and Rey Resources, with Buru and Rey retaining 40% and 20% interests respectively.

Buru said that Origin would provide individual carry amounts totalling $16million for the well costs of Rafael 1 and Kurrajong 1 and an additional $1 million payment to Buru in recognition of past costs.

The Work Program further includes the acquisition of extensive regional and prospect level seismic programs, with Origin carrying the first $3 million of seismic acquisition expenditure on the Buru Permits and the first $3 million of seismic acquisition expenditure on the Buru-Rey Permits.

Origin will also carry the first $4 million of expenditure if the joint venture decides to acquire a 3D seismic program over the Rafael prospect area within the Buru Permits after the drilling of the Rafael 1 well.

Origin has options to either withdraw or fund further activity in two of the Buru Permits. If fully exercised, these options require Origin to fund (on a carried basis) up to an additional $10 million of exploration expenditure to maintain its 50% interests in these two permits.

Similarly, to maintain its 40% interests in the Buru-Rey Permits, Origin must provide a carry of $6 million towards further exploration expenditure at its option.

Buru will remain as operator of all exploration permits, and the farm-out to Origin does not include the Yulleroo Gasfield, which has been retained 100% by Buru as a defined area.