MEO Australia is targeting early 2017 as a spud date for Cuba’s Block 9, taking its cue from Canada’s Sherritt International’s identifications in adjacent Bock 10, as it ponders a high impact exploration well in New Zealand and seeks to complete farm out processes in Australia. The Melbourne-based explorer said following assessment of the Lower Sheet play, continuing assessment of the remaining two plays, the Upper Sheet and Shallow Tertiary plays, was progressing as planned. Preliminary assessment was expected to be completed in the fourth quarter.

Dale

Light at the end of jobless tunnel for Geos?

The jobs outlook for Australia’s geoscientists has shown the first small signs of improvement in two years with the number of professional geoscientists in Australia seeking work or unable to secure satisfactory self-employment, falling in the June quarter compared with the preceding period. This is the first sign of any improvement in the sector – hard hit by the retreating mining resources boom – since September 2014 but the outlook remains dire with higher numbers looking to leave the profession for opportunities elsewhere.

BP wins deadlines extension for big Bight plan

NOPSEMA has granted BP an extension to lodge a third and final environmental plan to drill the Stromlo-1 well in the Great Australian Bight. The submission is now expected to be lodged by August 31 and BP now faces a race against time to begin drilling the Stromlo-1 well in the calmer seas of summer following assessment of the supermajor’s game plan and safeguards by the offshore regulator.

Woodside goes on African safari in Senegal.

Woodside has bought ConocoPhillips’ exploration stake in Senegal, acquiring a 35% stake in the SNE and FAN deepwater oil discoveries and the option of becoming operator, for US$430 million. The deal gives the Perth-based company exposure to a potential 560 million bbl oil discovery, which Woodside appears to have picked up for a significant discount at about US$2.30 per barrel to the US$7 per barrel valuation of RBC Capital Markets. Melbourne-based FAR Energy, which holds a 15% stake in the Senegal venture, was trading 13% lower at 7.3c in a trading halt.

BP invests in Bunker facility for Bight program

BRITISH Petroleum has signalled its commitment to Australia by announcing a multi-million dollar investment in infrastructure establishing a new fuel bunkering facility in Port Adelaide’s inner harbour. BP and Flinders Ports said the $8 million facility would support operations for BP’s planned $1 billion Great Australian Bight program which, subject to approval will see the first two wells drilled from late 2016, by providing safe, efficient and simultaneous refuelling of vessels and receipt of fuel into the terminal.

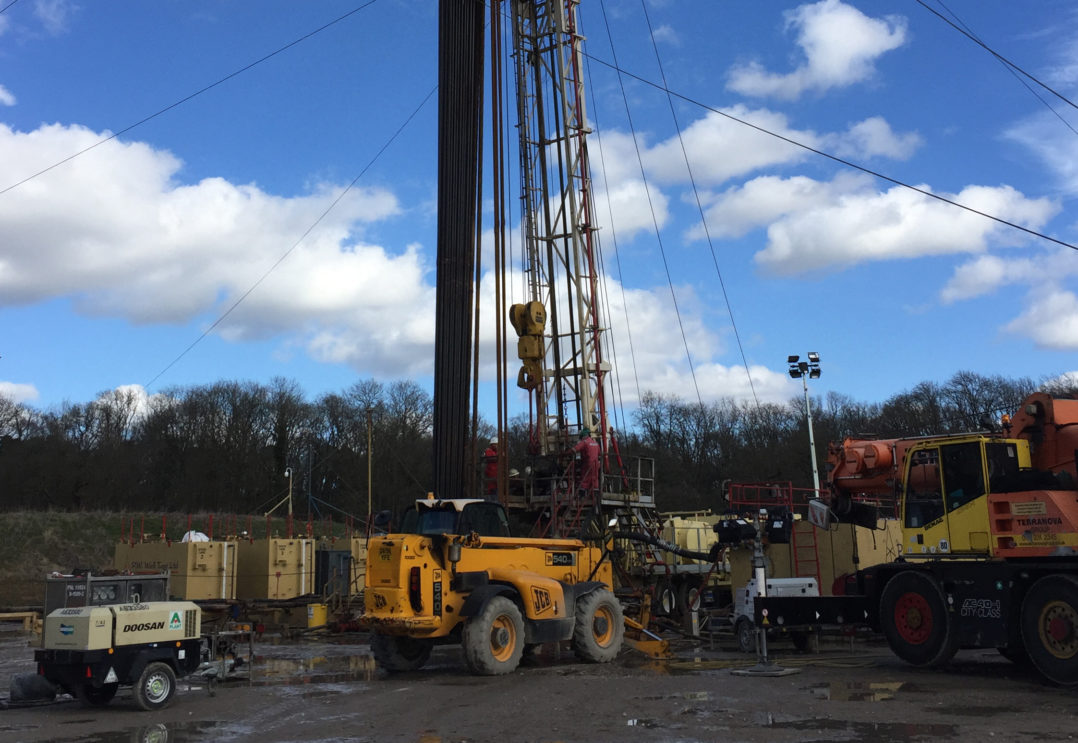

UKOG secures two-year retention for Horse Hill-1

UK Oil & Gas has retained its leases for the ‘Gatwick Gusher’, in southern England, which will enable the London-based company to continue production testing of the eagerly watched Horse Hill-1 oil discovery. The Horse Hill partners, also encompassing UK Oil & Gas Investments and Solo Oil, have retained PEDL137 and PEDL246 lease areas for a further two years by the UK Oil and Gas Authority. Horse Hill-1 has flowed 40 deg API of sweet crude at 1360 bopd from two bands of fractured Kimmeridgian Micrites at around 800-900m, spiking UKOG AIM-listed stock 77% to 1.

CGG wins prestigious award in Paris

CGG Processing Manager Singapore, Joe Zhou, has won the EAGE 2016 Guido Bonarelli Award in recognition of the best oral presentation for his paper entitled ‘Unlocking the full potential of broadband data with advanced processing technology, a case study from NWS Australia’. The paper was co-authored with Peter Chia from Shell Australia and Jingyu Li, Henry Ng, Sergey Birdus, Keat Huat Teng, Phan Ying Peng, Jason Sun and He Yi from CGG and presented during the 77th EAGE Conference & Exhibition in Madrid in June 2015.