An average capex of US$3 billion per year would be spent on eight oil and gas fields in Mozambique between 2018 and 2020. Capital expenditure into Mozambique’s oil and gas projects, will add up to $9.1bn over the three-year period in upstream capital expenditure by 2020, according to data and analytics company GlobalData. Ultra-deepwater projects will be responsible for over 65 percent of $9.1bn of upstream capital expenditure in Mozambique, or $6.2bn by 2020. The deepwater projects will account for 25 percent of upstream capital expenditure with $2.3bn by 2020, while onshore projects will necessitate $0.

Dale

ADNOC Signs Offshore Concessions with CNPC

The China National Petroleum Corporation (CNPC), the world’s third largest oil company, has been awarded stakes in two of Abu Dhabi’s offshore concession areas following the signing of agreements with the Abu Dhabi National Oil Company (ADNOC).. Under the terms of the agreements, CNPC, through its majority-owned listed subsidiary PetroChina, has been granted a 10% interest in the Umm Shaif and Nasr concession and a 10% interest in the Lower Zakum concession.

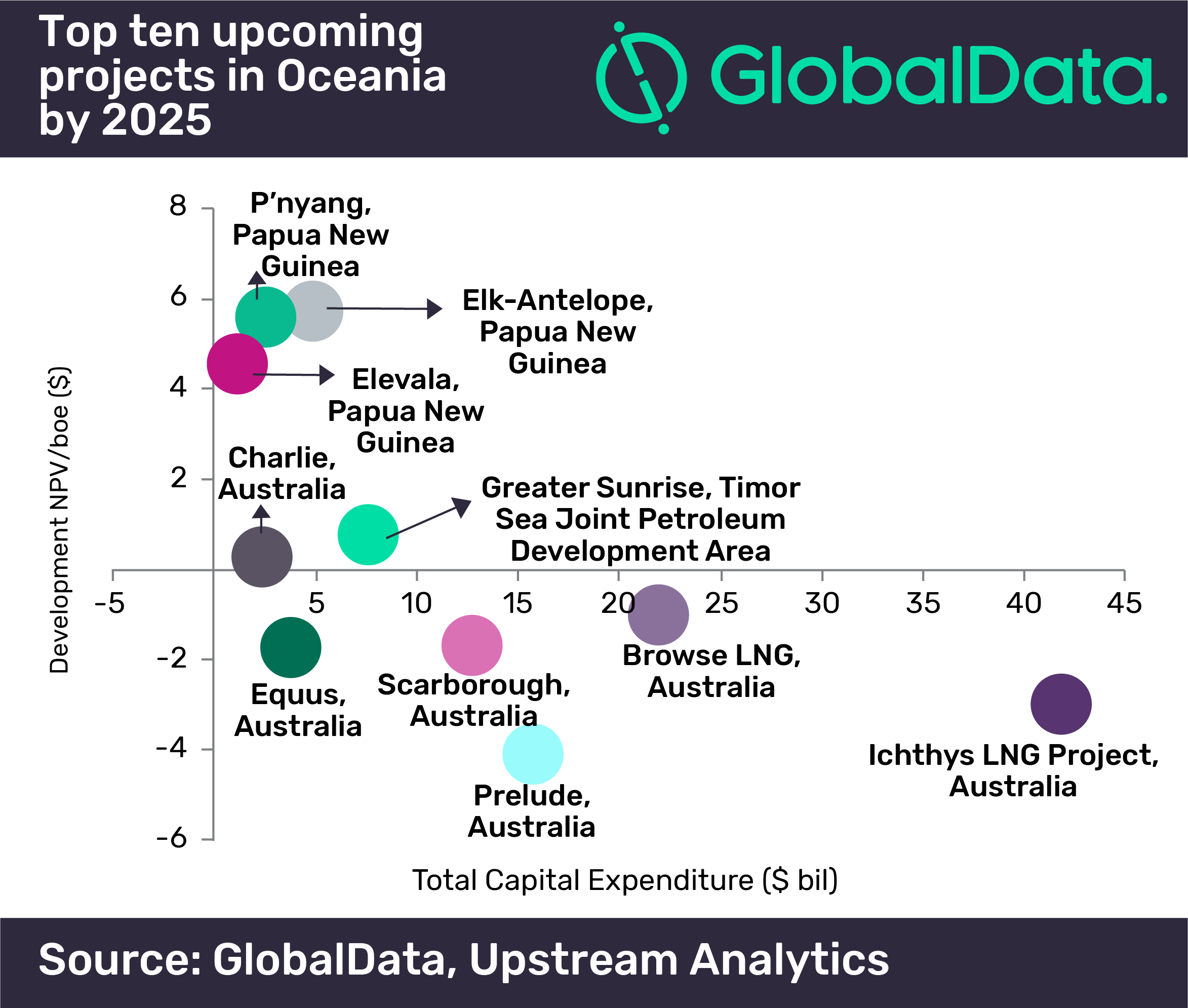

Over $114bn will be spent on Oceania’s upstream projects by 2025

Over $114bn in capital expenditure will be spent over the lifetime of the top ten upcoming oil and gas upstream projects in Oceania, to produce 8,683 million barrels of oil equivalent, according to data and analytics company, GlobalData. These 10 projects, selected from 30 upcoming projects in Oceania, will contribute incremental capacity of 808 thousand barrels of oil equivalent to global supply by 2025. Out of top ten upcoming projects, nine are conventional gas developments and the remaining is a coalbed methane (CBM) development. Ichthys LNG Project in Australia is the largest with anticipated peak production at 333.

APPEA upbeat about post-election Bight prospects in SA

APPEA has congratulated Steven Marshall and the South Australian Liberal Party on their election victory and said it "looks forward to working with the new government to secure South Australia’s economic and energy future". The oil and gas industry has been a significant contributor to the state’s economy and community for more than 60-years and can play a key role in developing much-needed energy resources in South Australia, onshore and offshore, APPEA said in a media release. "That includes the prospective exploration and development of oil and gas resources in the Great Australian Bight.

Japan is the land of rising LNG regasification

With Australia tipped to overtake Qatar as the world’s No.1 LNG producer – this year according to the IGU and 2021 by the Australian Federal Government’s estimate – the Lucky Country may be interested to know that Japan is the global regasification champion. Analysis of the global LNG regasification capacity by leading data and analytics company, GlobalData, shows that Japan has the highest LNG regasification capacity globally with 9.6 trillion cubic feet (tcf) in 2018. South Korea and China follow with 4.9 tcf and 3.2 tcf, respectively.

‘It’s about the economy stupid’

The Australian oil and gas sector is rebounding and is about to receive a further boost from government, the audience heard at the Australasian Oil and Gas Exhibition and Conference (AOG) in Perth last week. In an address that resonated with Bill Clinton’s successful 1992 campaign slogan, ‘It’s all about the economy stupid’, Western Australian Premier Mark McGowan told the opening session of the AOG 2018 Collaboration Forum that his government was developing an LNG Jobs Taskforce.

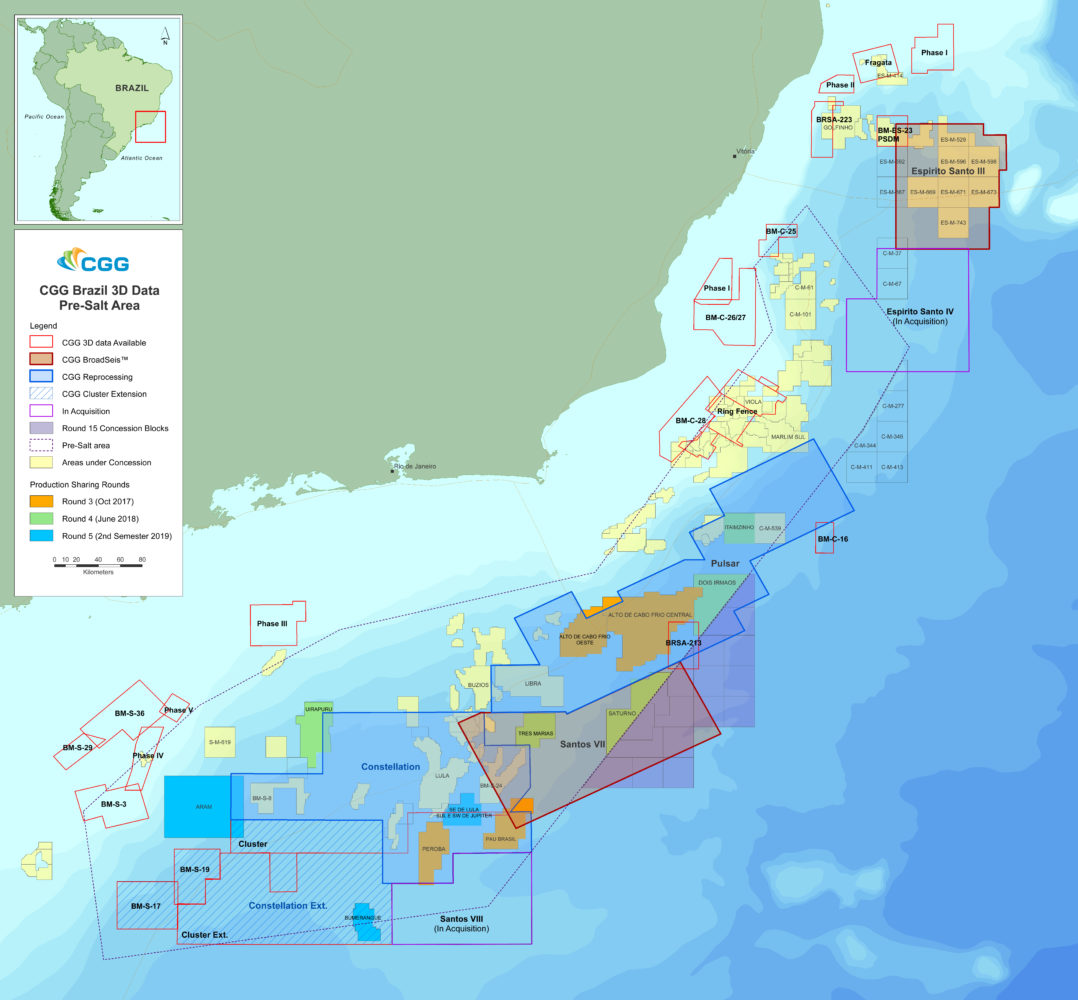

CGG adds new Santos VIII multic-client survey to broadband coverage offshore Brazil

CGG has commenced acquisition of a large broadband 3D multi-client survey in the pre-salt area of the deepwater Santos Basin. The geoscience company said Santos VIII is the most recent survey in CGG’s vast on-going pre-salt program that delivers “ultramodern seismic data, enabling exploration companies to better evaluate pre-salt opportunities in advance of Brazil’s pre-salt licensing rounds”. Santos VIII covers an area of over 8,000 km2 adjacent to the Peroba, Pau Brasil and Boumerangue fields.

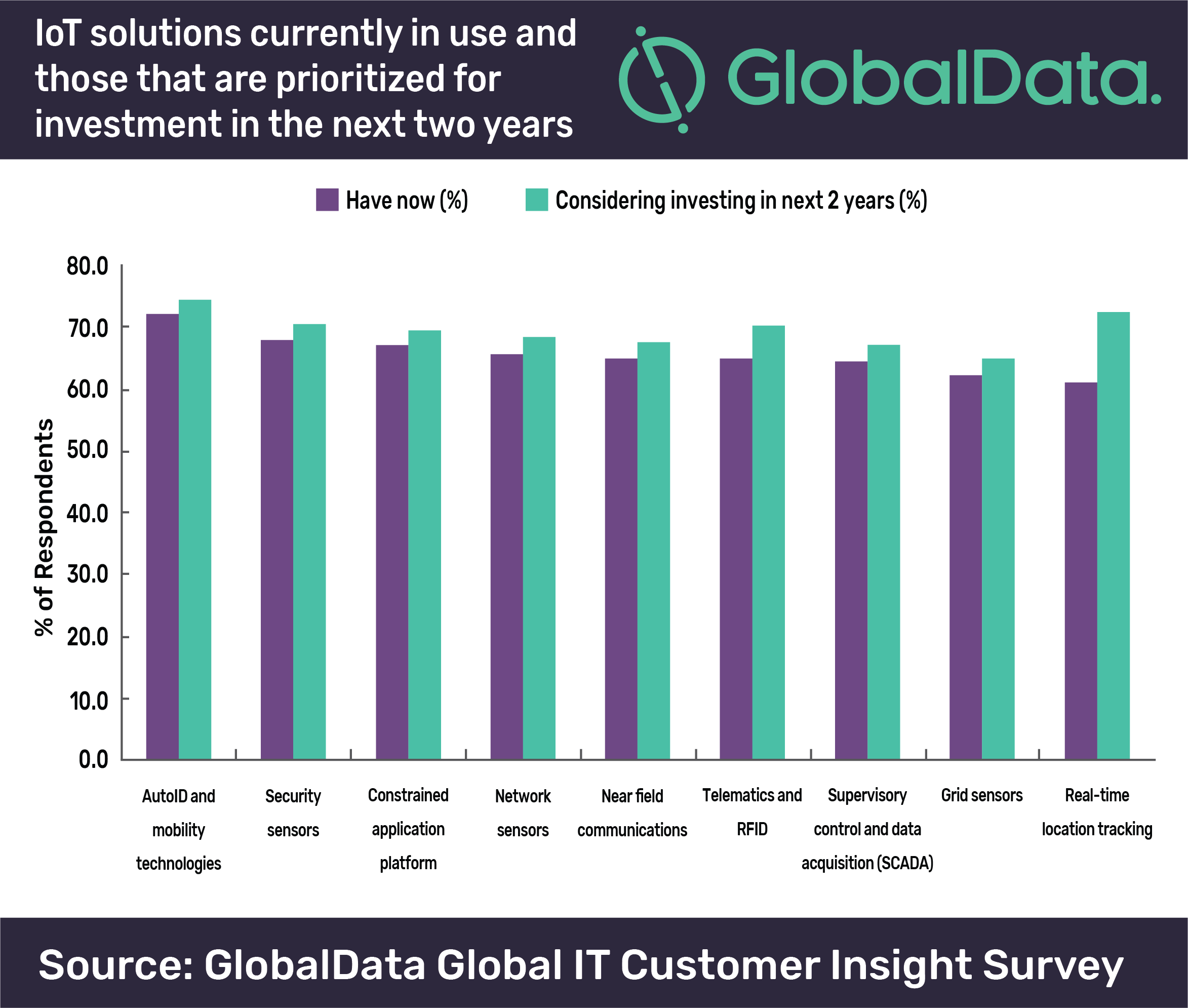

Energy industry on the cusp of large-scale digital transformation, says GlobalData

The global energy industry is facing major challenges from the ongoing environmental issues, changing regulations, low oil prices, and high capital and operating costs. They are forcing energy firms, which are traditionally considered conservative, to undergo a great deal of innovation and adopt disruptive technologies, according to leading data and analytics company, GlobalData. The company’s report ‘Technology Trends in Energy’ casts a lens over the technology trends affecting the energy industry, with a special focus on the oil and gas landscape.

Transocean rig heading for Phoenix South well

The Transocean-owned semi-submersible drilling rig GSF Development Driller-1 has started the final leg of its journey from Port Louis (Mauritius) to Australia for the task of drilling the Phoenix South-3 well for Quadrant Energy. Quadrant is the operator of the Phoenix project off Western Australia with an 80% interest with Carnarvon Petroleum holding the remaining 20%. Carnarvon said in a market update that slower than anticipated towing speeds had delayed the rig’s arrival, which was now scheduled for late March for drilling in early April.

CGG appoints three new board members

Following a board meeting on March 8, CGG has appointed three new board members. The company announced that Colette Lewiner will replace Hilde Myrberg, who will step down following a meeting to approve the financial statements for the fiscal year ending 31 December 2018. Lewiner graduated from Ecole Normale Supérieure and has a PhD in Physics. She is a nuclear energy specialist and worked for many years in the consultancy business in energy, utilities and chemicals. She is presently independent board director at EDF, Groupe Bouygues, GETLINK (former Eurotunnel), EDF, Nexans and Ingénico. Mario Ruscev replaces Dr.