Anadarko Petroleum is weeks away from an anticipated final investment decision for its Mozambique LNG project next month.

Chevron exited takeover talks with Anadarko last week, but the company is still being wooed by Oxy and said that FID for the Mozambique offshore gas project would be made on June 18.

Anadarko CEO Al Walker said: “With commitments for financing in place, off-take secured, and all other issues under negotiation successfully addressed, we are excited to take the next step with the expected announcement of a Final Investment Decision (FID) for the Mozambique LNG project on June 18.

“Mozambique LNG is among the most significant projects that our company or any other has undertaken, given the scale of the project, size of the resource, and the potential long-term transformational benefits it represents for Mozambique.

“We are grateful for the continued support of the people and government of Mozambique, our co-venturers, and the thousands of men and women working in the Cabo Delgado region to develop this exciting project. We look forward to celebrating the official sanctioning of Mozambique LNG on June 18.”

Mozambique President Felipe Jacinto Nyusi, added: “We expect June 18 will become a historic day in Mozambique as we announce that one of the most important and transformational projects in our country’s history is ready to advance to the next stage. We recognize Anadarko’s continued commitment to moving this project forward to becoming a reality.”

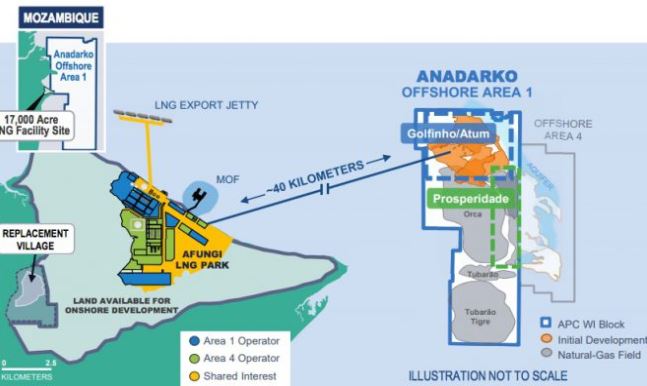

Anadarko is thus on the cusp of giving the green light to Mozambique’s first onshore LNG facility consisting of two initial LNG trains with a total nameplate capacity of 12.88 MTPA to support the development of the Golfinho/Atum field located within Mozambique’s Offshore Area 1. The Golfinho/Atum Project will supply initial volumes of approximately 100 million cubic feet of natural gas per day (MMcf/d) (50 MMcf/d per train) for domestic use in Mozambique.

Anadarko has revealed talks to finalize further gas sales deals for the project, having already announced Sale and Purchase Agreements (SPAs) totaling more than 9.5 million tonnes of LNG per annum year. Anadarko said the deals under discussion would bring the total volume to more than 11 MTPA.

Buyers include CNOOC, Tokyo Gas, Centrica, Shell, Tohoku, Bharat, and EDF.