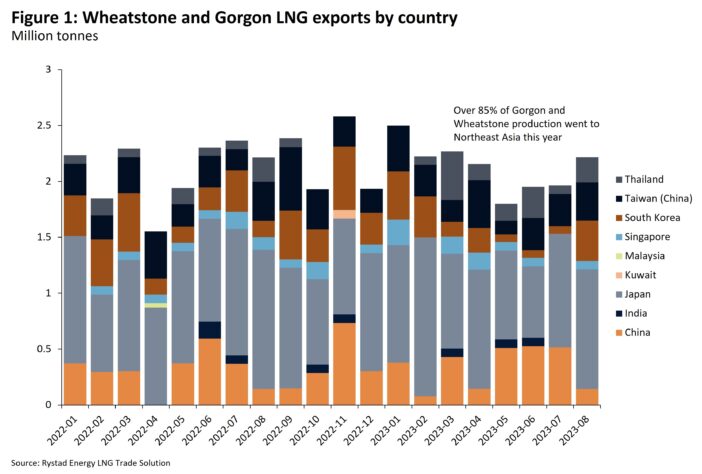

Strikes are the only thing keeping shoulder season prices buoyant.

Volatility has returned to gas markets as workers at Chevron’s Wheatstone platform and LNG facility, as well as the Gorgon LNG facility, went on strike on 8 September after the five-day negotiations with the US supermajor failed.

In a gas and LNG market update, Rystad Energy’s vice president Kaushal Ramesh noted that the front-month Title Transfer Facility (TTF) had opened at over $12 per million British thermal units (MMBtu) on 8 September – 25% lower than the recent high on 22 August when concerns over the impact of the strike were only pervasive.

However, Ramesh added that the potential impact of the strikes was likely the only bullish element in the near-term market, “given we have now entered the pre-winter shoulder season and other indicators are bearish in both Europe and Asia”.

A complete shutdown of production at Gorgon and Wheatstone would impact around 6% of global production but this remains a tall risk in our view, given the precedent already established at the neighboring Northwest Shelf, the report said.

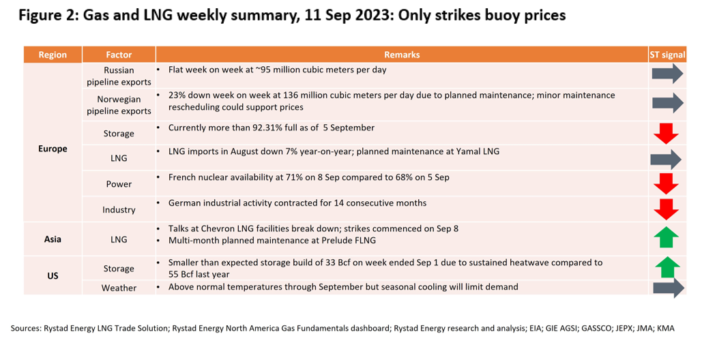

Given the importance of these facilities for Northeast Asian buyers – more than 68% of capacity is contracted to Northeast Asian buyers (with actual exports to Northeast Asia over 80%) – we anticipate Chevron is under pressure to accelerate a resolution.

At the risk of sounding like a broken record, the countries where winter demand could surge (and price insensitive) are very comfortable this year, the report said.

European storage is now over 92% full, while South Korea and Japan have additional nuclear capacity available this winter year-on-year.

As such, an increase in prices is more likely than not to simply see demand from the more price-sensitive countries recede.

Recent economic data from Germany also paints a bearish picture for the rest of the year.

As of July, German industrial production remains 7% below pre-Covid levels, and production in energy intensive sectors is 11% down on the year.

The economic outlook has worsened since GDP data for the second quarter implied a stagnating, rather than a contracting economy.

Industrial gas consumption is likely to be wary of the current unstable equilibrium in the gas market and, as such, a material recovery can only be expected once a period of sustained calm is achieved – the $2.7/MMBtu spread on the forward curve between November-delivery and January-delivery is not helping.

Meanwhile EnergyQuest said the ongoing negotiation between the unions and Chevron was not for the faint-hearted.

Describing Gorgon and Wheatstone as “global scale LNG projects”, EnergyQuest said a combined total of 26.3 million tonnes per annum (Mtpa) from the two plants represented 52% of WA’s LNG production (year to end June 2023) and 32% of Australia’s.

Gorgon and Wheatstone also supply 44% of Western Australia’s domestic gas.

Daily revenue from the Chevron projects was estimated by EnergyQuest at A$76 million/day.

Japan imports a total of 72 Mtpa, of which Australia provides 33.5 Mtpa or 43% of Japan’s requirements – by far its biggest supplier. Gorgon and Wheatstone ship 11.7 Mtpa or 16% of Japan’s LNG.

Rick Wilkinson, CEO of EnergyQuest said: “The Chevron industrial negotiations are not for the faint-hearted. They put at risk a third of Australia’s LNG exports and almost half of Western Australia’s domestic gas supply.

“The daily revenue at risk to Chevron and its partners – an estimated A$76 million per day – means a quick solution is a priority’

“Japan, as Australia’s largest buyer of LNG, now has 16% of its national LNG supply caught up in one industrial dispute in Western Australia.”