Author: Adam CraigA*

A RISC Advisory Pty Ltd, Perth, Western Australia

* Correspondence to. Email: adam.craig@riscadvisory.com

Abstract

Petroleum exploration expenditure in 2023 increased modestly over that of 2022. But remains well below expenditure highs of a decade ago, which was dominated by offshore activity. Exploration expenditure, and activity, is now dominant in onshore state jurisdictions. This has been the case since 2019 and will continue with no Federal offshore petroleum exploration acreage release rounds or exploration permit awards in 2023. Exploration expenditure (and activity) appears to be de-linked from increases in commodity prices which have typically been exploration stimuli in the past. This suggests that other factors including access to acreage, regulatory burden, legal challenge, social and environmental, are at play.

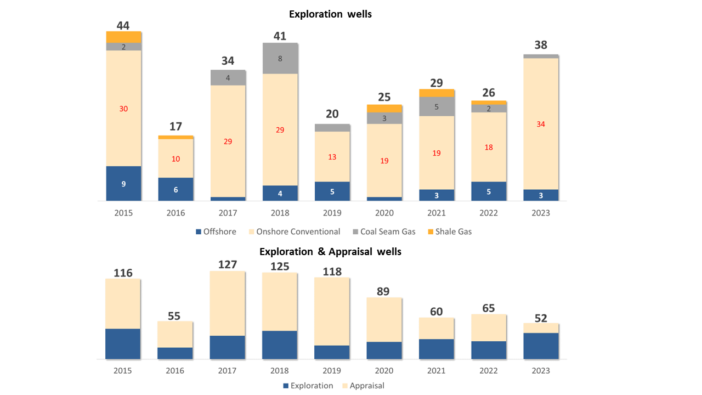

Despite the modest increase in exploration expenditure there were 38 exploration wells drilled in 2023, an increase from the 26 wells drilled in 2022. Three of these 2023 wells were located offshore, targeting prospective resources in the vicinity of LNG project upstream gas fields. Thirty-four conventional onshore exploration wells were drilled in 2023 compared to 18 in 2022, a significant increase. The Cooper-Eromanga Basin is the focus of onshore exploration drilling with 21 exploration wells, compared to 13 in 2022, which yielded 6 discoveries. Exploration success rates in the Cooper-Eromanga Basin are declining coincident with total well count. The onshore Northern Perth Basin continues to be an exploration hot-spot with 5 wells drilled in 2023, compared to 4 in 2022. The Permian Kingia Sandstone exploration play continues to deliver exploration success, with discoveries at North Erregulla Deep-1, Trigg Northwest-1, South Erregulla-3 and Tarantula Deep-1.

There were 5 exploration permits awarded in onshore Western Australia and 2 in Queensland. These permits were awarded with modest exploration work programs. With no Federal offshore exploration permit awards in 2023 and 9 exploration permits surrendered, exploration activity is likely to be modest and focussed on prospective resources for upstream gas supply for domestic gas and LNG projects.

The interest in carbon capture and storage projects and assessment acreage continues with a Federal offshore GHG release round in 2023 and 26 onshore state jurisdiction GHG assessment permits awarded or nominated preferred tender status.

Introduction

This paper attempts to be a concise summary of petroleum exploration and appraisal activity in Australia for 2023. Exploration trends, acreage releases, bids and awards, seismic acquisition, drilling activity and transactions are discussed.

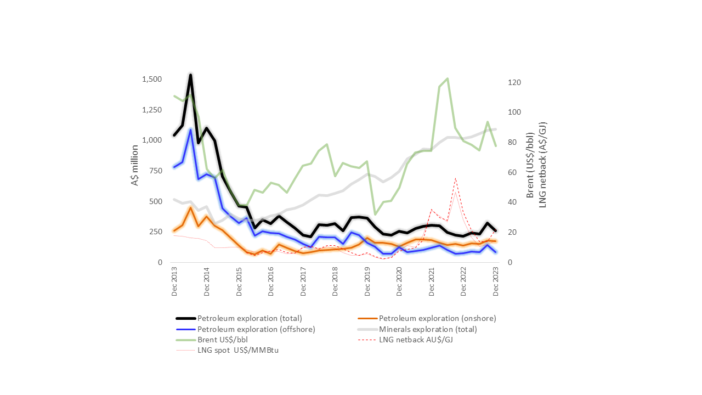

Petroleum Exploration Trends

Petroleum exploration expenditure for 2023, as reported by the Australian Bureau of Statistics (‘ABS’) increased slightly in 2023 but is still substantially below the highs of a decade ago. Following the COVID pandemic influenced lows of 2020, exploration expenditure had increased in 2021, declined again in 2022, but in 2023 has increased modestly. Expenditure increased 7% to an annual total of A$1,058 million (Fig. 1).

Fig. 1. Quarterly petroleum exploration expenditure 2013 – 2023 in comparison to minerals exploration spend (ABS, 2024) against Brent oil price and LNG netback price (ACCC, 2024).

Onshore exploration spend continues to exceed offshore spend since late-2019. Onshore exploration spend in 2023 was A$658 million, an increase of 10% from 2022, whilst offshore exploration spend was A$400 million (up 4%).

From petroleum exploration spend highs in 2013-14, spend decreased in line with the oil price. However, since 2016, increases in the oil price have not resulted in increased petroleum exploration expenditure which has remained flat since 2016. Exploration spend did not respond significantly to increases in the east-coast LNG net-back price (LNG netback price as reported by the Australian Competition & Consumer Commission (‘ACCC’), refer ACCC (2024)) or east-coast domestic gas prices since 2021.

Petroleum exploration spend in Australia is approximately one-quarter of the minerals exploration spend and this trend is expected to continue with increased focus on ‘energy transition’ critical minerals.

Like previous years, state Government petroleum exploration incentive programs have been made available in an effort to stimulate petroleum exploration and development. Grants and collaborative funding schemes were available in 2023 for the states of Queensland, the Northern Territory, and Western Australia.

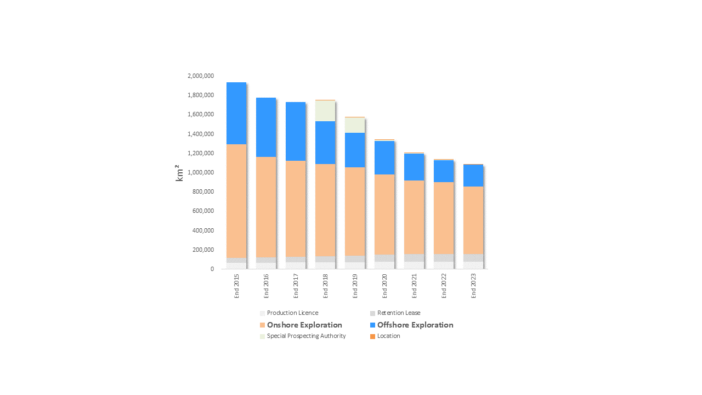

The total area under petroleum title in Australia continued to decline in 2023 (Fig. 2). Total area under exploration title has decreased 49% since 2015. Over the same period offshore exploration title area has decreased 65% (on average 10% per annum) and onshore exploration title area has decreased 41% (on average 5% per annum). Following the fourteen titles surrendered in 2022, nine Federal waters offshore exploration permit titles were surrendered in 2023.

Fig. 2. Area under petroleum title 2016 – 2023.

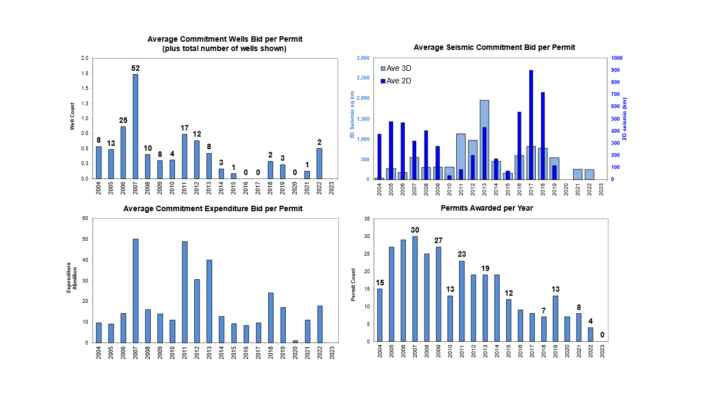

Analysis of acreage bids and awards for Federal offshore release rounds shows that there has been a general trend of decreasing annual exploration title awards since a peak in 2007 (Fig. 3). There had been an increase in the number of firm exploration wells included in the winning work program bids and consequently the average commitment spend. It is also worth noting that seismic commitments have been decreasing and that 2D seismic acquisition has not been a feature of work program bids since 2019. It must be noted that there were no offshore exploration permit awards in Federal waters in 2023, as was there no acreage release round and this is discussed further in following text.

Fig. 3. Federal offshore release round permit award analysis 2004 – 2023.

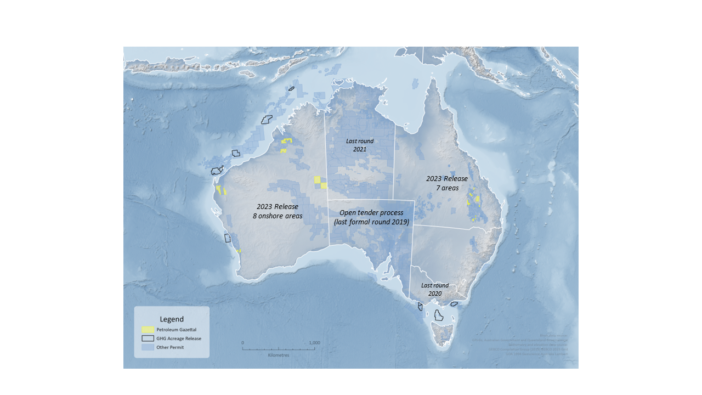

Fig. 4. 2022 exploration acreage releases in Australia.

A Federal offshore greenhouse gas (‘GHG’) acreage release of 10 release areas (Fig. 4) was announced on 29 August 2023 with bids closing on 28 November 2023.

Petroleum Exploration Acreage Releases in Australia

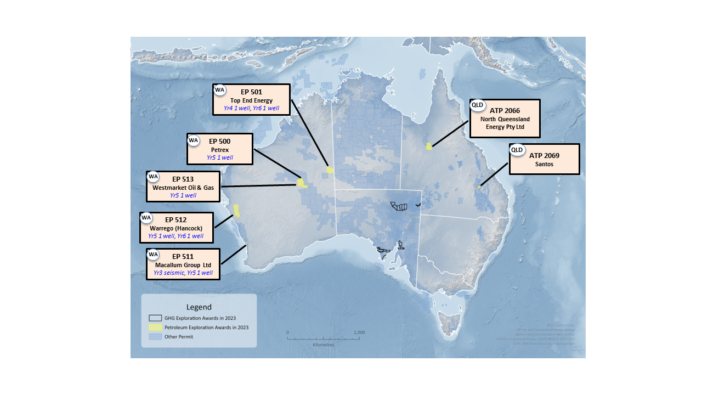

There was a total of 7 petroleum exploration permits awarded in Australia in 2023, a summary of which is presented in Fig. 5. All of the acreage awards were in onshore state jurisdictions, with no Federal offshore petroleum exploration permits awarded in 2023.

Exploration Acreage Release Rounds

The delayed 2022 Federal offshore release round with 10 release areas closed in March 2023. According to the National Offshore Petroleum Titles Administrator (‘NOPTA’) online portal ‘NEATS’ there are currently 12 applications with the Joint Authority for endorsement from this and prior rounds. Nominations for areas to be included in a Federal offshore release round in 2023 closed in September 2022, however the release round was never launched.

Exploration acreage was however released for bidding in Western Australia and Queensland (Fig. 4). Eight onshore areas were released in Western Australia on 20 October 2023 with bids closing 19 January 2024. Seven areas were released in Queensland on 12 October with bids closing 20 December 2023.

A Federal offshore greenhouse gas (‘GHG’) acreage release of 10 release areas (Fig. 4) was announced on 29 August 2023 with bids closing on 28 November 2023.

Petroleum Exploration Acreage Awards

There was a total of 7 petroleum exploration permits awarded in Australia in 2023, a summary of which is presented in Fig. 5. All of the acreage awards were in onshore state jurisdictions, with no Federal offshore petroleum exploration permits awarded in 2023.

There was a total of 7 petroleum exploration permits awarded in Australia in 2023, a summary of which is presented in Fig. 5. All of the acreage awards were in onshore state jurisdictions, with no Federal offshore petroleum exploration permits awarded in 2023.

Fig. 5. Summary of petroleum exploration permit awards in 2023.

In Western Australia there were 5 exploration permits awarded. In the Officer Basin EP 500 was awarded to Petrex Australia and EP 513 was awarded to a subsidiary of Georgina Energy PLC. In the Amadeus Basin EP 501 was awarded to Top End Energy Ltd. In the Perth Basin EP 511 was awarded to Macallum Group Ltd and EP 512 was awarded to Warrego Energy being a subsidiary of Hancock Energy. In Queensland ATP 2066 in the Millungera Basin was awarded to North Queensland Energy Pty Ltd and ATP 2069 in the Bowen Basin was awarded to Santos.

Greenhouse Gas Storage Assessment Permit Awards

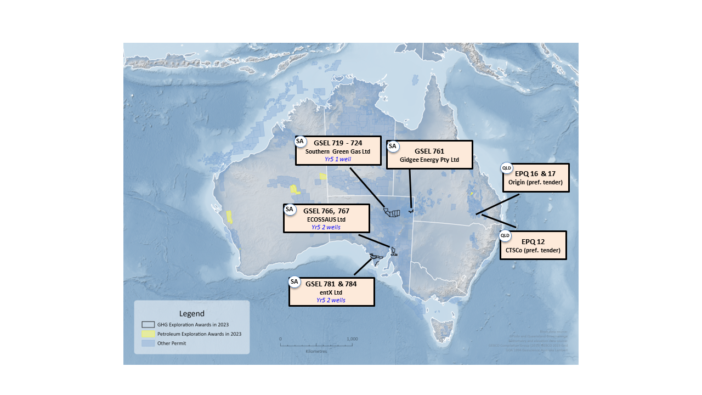

There were 29 greenhouse gas (‘GHG’) assessment permits awarded in South Australia in 2023. In Queensland 3 assessment permits are awaiting ratification with preferred tender status. There were no Federal offshore GHG assessment permits awarded (Fig. 6).

Fig. 6. Summary of greenhouse gas storage assessment permit awards in 2023.

In South Australia, GSEL 719 to 724 were awarded to Southern Green Gas Ltd in the Western Eromanga whilst GSEL 761 was awarded to Gidgee Energy Pty Ltd in the Cooper-Eromanga Basin. In the Adelaide Geosyncline GSEL 766 and 767 were awarded to ECOSSAUS Ltd, whilst in the Polda Basin GSEL 681 and 784 were awarded to entX Ltd.

In Queensland, Origin Energy is the preferred tenderer for EPQ 16 and 17 in the Surat Basin, whilst CTSCo, a subsidiary of Glencore, is the preferred tenderer for EPQ 12 also in the Surat Basin.

Seismic Acquisition

The multiclient Capreolus 3D Phase II survey was acquired in the Bedout Sub-basin of the Northern Carnarvon Basin in addition to the Scarborough 4D baseline survey in the Exmouth Sub-basin. In the Northern Perth Basin, the Eneabba Deep 2D survey was acquired. There was significant seismic acquisition in the Cooper-Eromanga, as well as the Bowen and Surat Basins (Fig. 7).

Fig. 7. Seismic surveys acquired in Australia, 2023.

Exploration Drilling

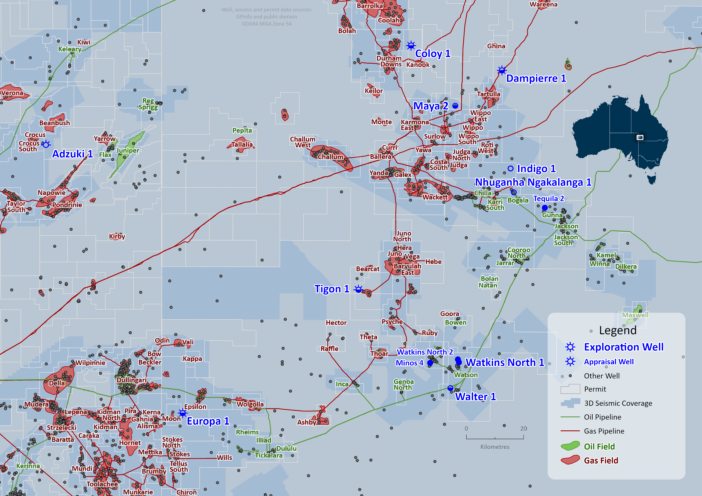

Thirty-eight exploration wells were drilled in Australia in 2023 in addition to 14 appraisal wells (Fig. 8 and 9).Three ofthese exploration wells were offshore, with the remainder being onshore. Of the 35 onshore exploration wells, 21 were located in the Cooper – Eromanga Basin, the remainder being located in the Perth Basin (5), Bowen Basin (4), Surat Basin (2), Stansbury Basin (2) and Georgina Basin.

Fig. 8. Exploration and appraisal wells drilled in 2023.

Fig. 9. Exploration wells by type and total exploration and appraisal wells (2015 – 2023).

Beach Energy was the most active company in exploration drilling, operating or participating in 23 of the 38 exploration wells.

Of the 35 exploration wells drilled onshore in 2023, there were 12 discoveries (34% success rate). The discoveries were; North Erregulla Deep-1, Trigg Northwest-1, South Erregulla-3 and Tarantula Deep-1 in the Northern Perth Basin, Watkins North-1 Dampierre-1, Europa-1, Coloy-1, Bangalee South-1 and Callawonga North-1 in the Cooper-Eromanga Basin and Canyon-1 and 2 in the Surat Basin.

The number of exploration wells drilled per year has generally been increasing since 2019 (Fig. 9). The 38 exploration wells drilled in 2023 was a significant increase from the 26 wells in 2022, 29 in 2021, 25 in 2020 and 20 in 2019.

Offshore

The three exploration wells drilled offshore were all plugged and abandoned, failing to intersect hydrocarbons. It is worth noting that all three wells were drilled by LNG project joint ventures in the vicinity of developed fields as part of those LNG projects with the objective of exploring for potential tiebacks and production plateau extensions, rather than exploring for potential ‘standalone’ fields or new exploration plays.

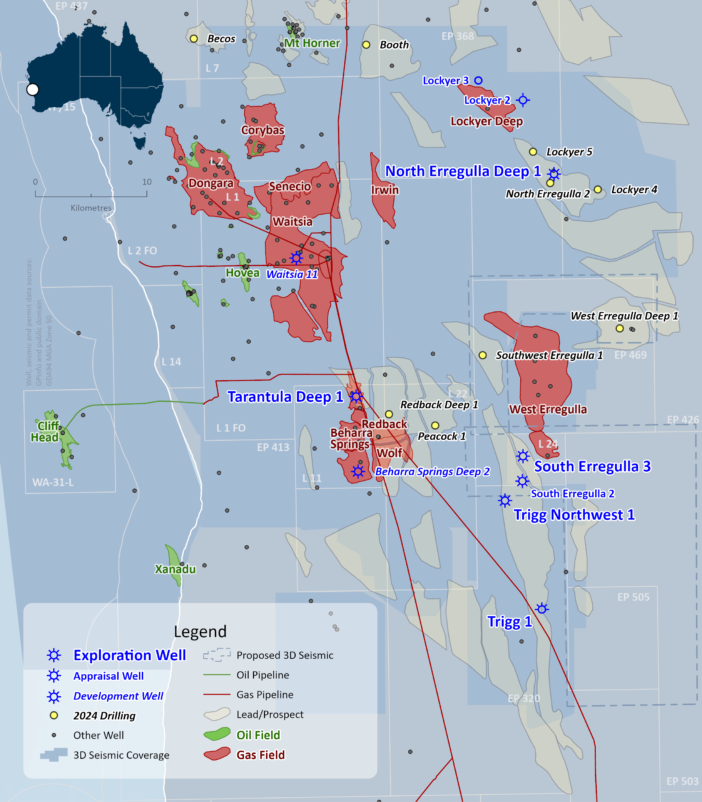

Onshore, Perth Basin

There were 5 exploration wells and 3 appraisal wells drilled in the onshore Northern Perth Basin in 2023 (Fig. 10). Following the exploration success at Lockyer Deep-1 in 2021, Mineral Resources drilled the down-dip Lockyer-2 appraisal well in EP 368 to a total depth (‘TD’) of 4,574 mMD and intersected water wet Kingia Sandstone primary objective (Mineral Resources, 2023a). Lockyer-3 to the northwest of Lockyer Deep-1 was drilled to a total depth of 4,590 mMD intersecting 13 m of net gas pay in the Kingia Sandstone (Mineral Resources, 2023b).

Fig. 10. Northern Perth Basin exploration and appraisal wells drilled in 2023.

North Erregulla Deep-1 drilled by Mineral Resources to a TD of 4,446 mMD in the EP 368 exploration permit, intersected 28 m of net gas pay over a 37 m gross interval of the primary objective Kingia Sandstone. In addition the well intersected an interpreted 47 m of net oil pay from a 90 m gross Dongara Sandstone interval (Mineral Resources, 2023c). The well tested at rates up to 99 MMscf/d (Mineral Resources, 2023b).

Beach Energy drilled the Trigg-1 and Trigg Northwest-1 wells in the EP 320 exploration permit. Trigg-1 was drilled to a TD of 4,914 mMD and was plugged and abandoned with gas shows in the primary objective Kingia Sandstone. Gas could not be recovered on wireline testing, with the reservoir evaluated to be tight (Beach Energy, 2023a). Trigg Northwest-1, also in EP 320, was drilled to a TD of 5,000 mMD and intersected a 6 m net gas column in the Kingia Sandstone objective over a 49 m gross interval (Beach Energy, 2023b). Beach also drilled the Tarantula Deep-1 well in the L 11 production license to a TD of 4,121 mMD and intersected a 10 m net gas column in the Kingia Sandstone over a 63 m gross interval (Beach Energy, 2023b). At year end the Beharra Springs Deep-2 appraisal well was drilling.

South Erregulla-2 drilled by Strike Energy in EP 503 is considered to be an appraisal well of the Trigg Northwest-1 well discovery and was drilled to a depth of 4,843 mMD intersecting a 45 m gross Kingia Sandstone interval. It was reported that the well had a 16 m net gas column with up to 18% porosity and an average of 11% (Strike Energy, 2023a). However, the well recovered gas and water on test without establishing flow (Strike Energy, 2024). South Erregulla-3, also in EP 503, drilled in a separate mapped fault compartment intersected an interpreted 13 m net gas pay over a 54 m gross Kingia Sandstone interval with up to 16% porosity and an average of 10% (Strike Energy, 2023b). However, the well failed to flow on test (Strike Energy, 2024).

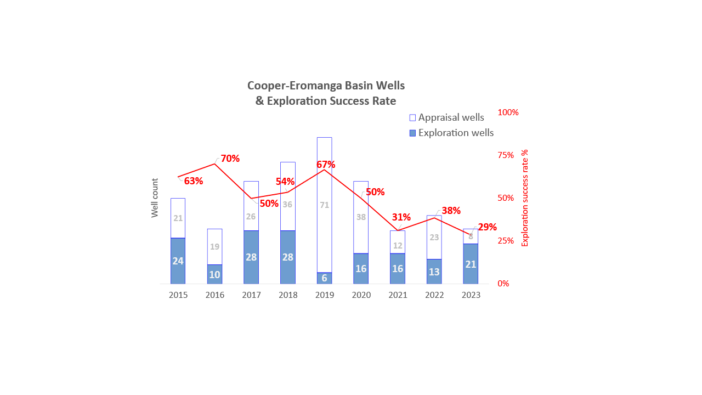

Onshore, Cooper – Eromanga Basin

There were 21 exploration and 8 appraisal wells drilled in the Cooper – Eromanga Basin in 2023. This exploration well count is the highest since 2018 and yielded 6 discoveries. The exploration success rate of 29% is a decline from the 38% success rate in 2022, but comparable to the 31% success rate in 2021 (Fig. 11). There is a general tend of declining exploration success in the Cooper – Eromanga which is also coincident with a decline in the total exploration and appraisal well count. Past exploration success has been attributed to application of a new technology (i.e. 3D acquisition, better statics definition, pre-stack depth migration processing) but no such ‘breakthrough’ or new exploration play was apparent in 2023.

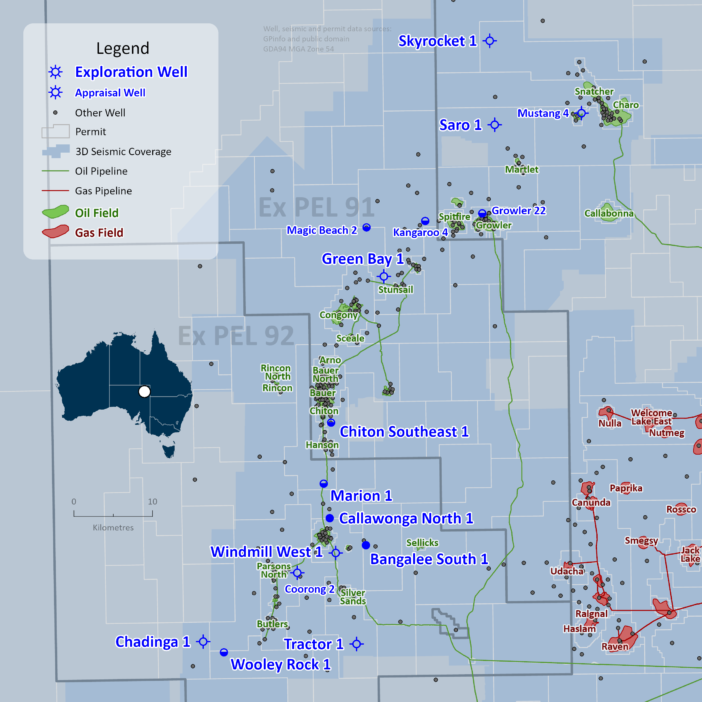

In the Beach Energy operated ‘Western Flank’ (Fig. 12) there were 2 oil discoveries. Bangalee South-1 intersected a 2.9 m oil column in the Namur Sandstone primary objective and a 4.3 m oil column in the Birkhead Formation secondary objective (Beach Energy, 2023b). Callawonga North-1 intersected a 3.2 m oil column in the primary objective Namur Sandstone (Beach Energy, 2024). Chiton Southeast-1 intersected a sub-commercial oil column in the Namur Sandstone and was plugged and abandoned (Beach Energy, 2023a). Saro-1 and Skyrocket-1 were high risk exploration wells to test oil migration in the northern portion of the Western Flank and both failed to intersect hydrocarbons (Beach Energy, 2023b).

Fig. 11. Cooper–Eromanga Basin exploration and appraisal well count vs exploration success rate.

Fig. 12. Cooper – Eromanga Basin ‘Western Flank’ exploration and appraisal wells drilled in 2023.

In the central and eastern portion of the Cooper – Eromanga Basin (Fig. 13) there were 4 discoveries; an oil discovery at Watkins North-1, and gas discoveries at Dampierre-1, Europa-1 and Coloy-1. Dampierre-1 was drilled in ATP 2023 where Santos farmed in during 2022 taking over operatorship from Bridgeport.

Fig. 13. Cooper – Eromanga Basin central and east area exploration and appraisal wells drilled in 2023.

Onshore, other

Other onshore wells of note include the Canyon-1 and 2 exploration wells drilled by Omega Oil and Gas, and the appraisal wells Daydream-2 drilled by Elixir Energy and Overston-6 drilled by Shell (QGC). These wells all targeted a Permian basin centred gas play within the Taroom Trough of the Surat – Bowen Basin. Omega Oil and Gas report that Canyon-1 and 2 intersected 360 – 400 m intervals of high gas readings with 83 m and 110 m of net gas pay respectively in the Tinowan Sandstone of the Back Creek Group (Omega Oil and Gas, 2023). Elixir Energy report 154 m of net gas pay (Elixir Energy, 2023) as well as intersecting a permeable sand of 12 m gross thickness which resulted in a gas influx to the well (Elixir Energy, 2024).

In South Australia, Gold Hydrogen drilled the Ramsay-1 and 2 wells in the PEL 687 exploration permit located on the Yorke Peninsula. The wells were drilled to follow-up historical reports of naturally occurring hydrogen in the 1931 Ramsay Oil Bore-1 well. Ramsay-1 was drilled to a TD of 1,005 mMD and Ramsay-2 was drilled to a TD of 1,068 mMD. Both wells were drilled within 0.5 km of the historical well, and hydrogen was reported at shallow depths from mudgas samples which were comparable to the historic analyses (Gold Hydrogen, 2023a, 2023b, 2023c & 2024). Elevated levels of helium were also reported from MDT samples.

In the Beetaloo Basin, Tamboran Resources drilled the Shenandoah South 1H exploration well which included a 1,000 m lateral section which was planned to be stimulated and placed on pilot production test.

Appraisal Drilling

There were 14 appraisal wells drilled in 2023, compared to the 39 appraisal wells drilled in 2022, 31 in 2021, 64 in 2020 and 98 in 2019. There has been a sustained decline in appraisal drilling since 2017 (Fig. 9). All appraisal wells drilled in 2023 were onshore as in 2022.

In the Perth Basin, Mineral Resources drilled the Lockyer-2 and 3 wells and Strike Energy drilled the South Erregulla-2 well. At year end Beach Energy was drilling the Beharra Springs Deep-2 well.

On the ‘Western Flank’ of the Cooper-Eromanga Basin appraisal wells included Magic Beach-2, Kangaroo-4, Growler-22, Mustang-4 and Coorong-2. In the central and eastern portion of the Cooper-Eromanga Basin appraisal wells include Tequila-2, Watkins North-2 and Minos-4.

Other appraisal drilling included the aforementioned Overston-6 and Daydream-2 wells in the Taroom Trough of the Surat – Bowen Basin, and the Amungee NW-3H well in the Beetaloo Basin.

Transaction and Farmin Deals

Perth Basin centric transactions in 2023 included the completion of the acquisition of Warrego Energy by Hancock Energy, the takeover of Norwest Energy by Mineral Resources and the takeover of Talon Energy by Strike Energy.

Mineral Resources announced the takeover of its Lockyer Deep joint venture partner Norwest Energy in December 2022 and completed in June 2023. The transaction was an all scrip offer and valued at approximately A$350 million. Strike Energy announced the takeover of its Walyering gas project joint venture partner Talon Energy in August 2023 and the scheme of arrangement was implemented in December 2023 valuing the transaction at A$155 million.

There were 2 exploration farmin deals announced in 2023. Greenvale Energy farming into the Mosman Oil and Gas operated EP 145 exploration permit in the Amadeus Basin, acquiring 75% working interest for funding 100% of the forward work program including seismic acquisition and the drilling of a well (Greenvale Energy, 2023). Following the Talon Energy farmin announced in 2022, New Zealand Oil and Gas also farmed into the Triangle Energy operated EP 437 exploration permit and L7 (Mt Horner) license in the Northern Perth Basin on a 2:1 promote on two wells (New Zealand Oil and Gas, 2023).

Other deals of note include the acquisition of 10% from Carnarvon Energy of the Dorado oil discovery and associated exploration permits in the offshore Bedout Sub-basin by CPC Corporation, and the acquisition of the 25% working interest held by joint venture partner Buru Energy by Mineral Resources in the onshore Carnarvon Basin permits EP 510 and L22-2 and 4 applications.

Equities Market

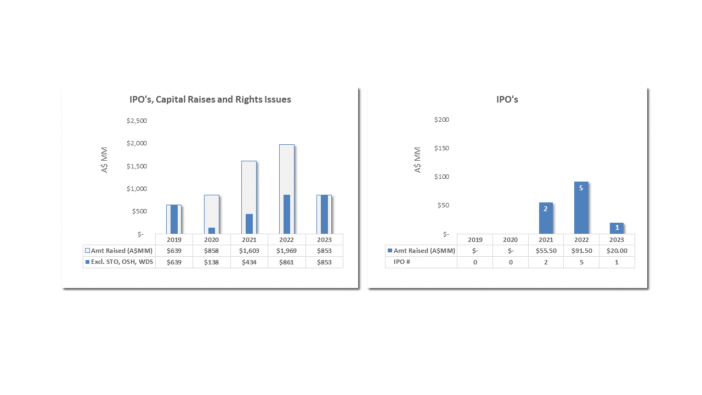

Activity in the equity market in 2023 was subdued compared to 2022. Capital raised by ASX listed petroleum exploration focussed entities was A$853 million in 2022 compared to A$861 million in 2022 after excluding the A$1.1 billion Woodside capital raise in 2022 (Fig. 14). This capital is to be deployed primarily for transactions and to execute work program on assets held globally and in Australia. The 2023 capital raisings were dominated by Karoon Energy (A$479 million) and Tamboran Energy (A$73.5 million).

Initial public offerings (‘IPO’s) of petroleum companies decreased with only 1 IPO in 2023 compared to 5 in 2022 and 2 in 2021. The only IPO was Gold Hydrogen raising A$20 million to fund the Ramsay-1 and 2 drilling program in PEL 687, South Australia.

Fig. 14. Capital raised by ASX listed entities in 2019 – 2023 (left) and IPO’s (right).

Conclusions

Petroleum exploration expenditure in 2023 increased modestly over that of 2022. Exploration expenditure, and activity, is now dominant in onshore state jurisdictions. With no Federal offshore petroleum acreage release round in 2023, no exploration permit awards, and the continued surrender of exploration permits, offshore exploration will gravitate to proven areas and tie-backs to domestic gas or LNG projects.

The Cooper-Eromanga Basin is the focus of onshore exploration drilling. However, exploration success rates in the Cooper-Eromanga Basin are declining coincident with the total exploration and appraisal well count. The onshore Northern Perth Basin continues to be an exploration hot-spot with exploration activity focussed on the Permian Kingia Sandstone exploration play.

Exploration success was generally modest, with the Northern Perth Basin gas discoveries being the most significant. There was no exploration ‘breakthrough’ or discoveries within a new exploration play.

Data availability. Data utilised in this study were obtained from public sources in addition to GPinfo, S&P Global and GlobalData.

Conflict of Interest. The author declares there are no conflicts of interest.

Declaration of funding. No funding from organisations external to RISC was received for the preparation of this paper.

Acknowledgements. The author would like to acknowledge the following key people and organisations; Simon Barber (RISC) for data collection and preparation of maps, Craig Gumley (Consultant) for his analysis of historic Federal offshore release round bids and awards, Matthew Quinn (S&P Global) for information on wells drilled and seismic acquired in the year, Rhys Simpson (EurozHartleys) and Peter Cameron (Australia Oil & Gas Research) for information on capital raisings and IPO’s. Data and information used in the compilation of this paper has been sourced from the aforementioned, combined with information extracted from GPinfo and GlobalData in addition to other publicly available sources.

References.

Australian Bureau of Statistics (2023). Mineral and Petroleum Exploration, Australia. Quarterly statistics on mineral and petroleum expenditure by private organisations in Australia. December 2022. https://www.abs.gov.au/statistics/industry/mining/mineral-and-petroleum-exploration-australia (Extracted 4 March 2023).

Australian Competition & Consumer Commission (2023). Gas inquiry 2017-30, LNG netback price series. https://www.accc.gov.au/regulated-infrastructure/energy/gas-inquiry-2017-30/lng-netback-price-series (Extracted 27 February 2023).

Beach Energy (2023a). FY23 Fourth Quarter Activities Report. ASX release 26 July 2023.

Available at https://yourir.info/resources/0c5a441cf54ff229/announcements/bpt.asx/2A1462850/BPT_FY23_Fourth_Quarter_Activities_Report.pdf

Beach Energy (2023b). FY24 First Quarter Activities Report. ASX release 25 October 2023.

Available at https://yourir.info/resources/0c5a441cf54ff229/announcements/bpt.asx/2A1482756/BPT_FY24_First_Quarter_Activities_Report.pdf

Beach Energy (2024). FY24 Second Quarter Activities Report. ASX release 25 January 2024. Available at https://yourir.info/resources/0c5a441cf54ff229/announcements/bpt.asx/2A1501183/BPT_FY24_Second_Quarter_Activities_Report.pdf

Elixir Energy (2023). Daydream-2 logs 154 metres of net pay. ASX release 14 December 2023. Available at https://wcsecure.weblink.com.au/pdf/EXR/02753833.pdf

Elixir Energy (2024). Daydream-2 update. ASX release 18 January 2024. Available at https://wcsecure.weblink.com.au/pdf/EXR/02763519.pdf

Gold Hydrogen (2023a). Ramsay Project Update, Significant Concentrations of Hydrogen and Helium Detected in the Ramsay 1 Well. ASX release 31 October 2023. Available at https://www.goldhydrogen.com.au/asx-releases/significant-concentrations-of-hydrogen-and-helium-detected-in-the-ramsay-1-well/

Gold Hydrogen (2023b). Very High Helium Concentrations at Ramsay 2. ASX release 6 December 2023. Available at https://www.goldhydrogen.com.au/asx-releases/very-high-helium-concentrations-at-ramsay-2/

Gold Hydrogen (2023c). Very High Concentrations of Hydrogen Found at Ramsay 2. ASX release 19 December 2023. Available at https://www.goldhydrogen.com.au/asx-releases/very-high-concentrations-of-hydrogen-found-at-ramsay-2/

Gold Hydrogen (2024). Quarterly Activities Report. ASX release 30 January 2024. Available at https://www.goldhydrogen.com.au/asx-releases/quarterly-activities-appendix-5b-cash-flow-report-for-the-period-ended-31-december-2023/

Greenvale Energy (2023). Greenvale to acquire high-quality and high-grad helium and hydrogen opportunity in central Australia. ASX release 17 October 2023. Available at https://clients3.weblink.com.au/pdf/GRV/02725940.pdf

Mineral Resources (2023a). Lockyer-2 gas appraisal well results. ASX release 12 April 2023. Available at https://clients3.weblink.com.au/pdf/MIN/02653457.pdf

Mineral Resources (2023b). Quarterly Exploration and Mining Activities Report. ASX release 25 October 2023. Available at https://clients3.weblink.com.au/pdf/MIN/02729518.pdf

Mineral Resources (2023c). Exploration and Lithium Business Update. ASX release 16 June 2023. Available at https://clients3.weblink.com.au/pdf/MIN/02676930.pdf

New Zealand Oil and Gas (2023). New Zealand Oil & Gas Executes Perth Basin Farm In Agreement With Triangle Energy, announcement 17 January 2023. Available at https://www.nzog.com/news/new-zealand-oil-and-gas-executes-perth-basin-farm-in-agreement-with-triangle-energy/

Omega Oil and Gas (2023). Completion of Omega’s Successful Drilling Campaign. ASX release 31 May 2023. Available at https://wcsecure.weblink.com.au/pdf/OMA/02671252.pdf

Strike Energy (2023a). Successful Appraisal of South Erregulla. ASX release 5 October 2023. Available at https://app.sharelinktechnologies.com/announcement/asx/b5ec3f8bc4a6e30150c52550a4ac2f49

Strike Energy (2023b). SE3 confirms continuity of South Erregulla gas field. ASX release 4 December 2023. Available at https://app.sharelinktechnologies.com/announcement/asx/9872bd66fea8a68cc5a3359d21679f57

Strike Energy (2024). Financial report for the half year ended 31 December 2023. Available at https://app.sharelinktechnologies.com/announcement/asx/9519d3365e406e49894fec5c21794b49